Japan has an intelligent, well-educated citizenry, strong business leaders and dedicated workers who created an industrial juggernaut that has been the envy of the world for decades. But Japan has a problem.

With no natural gas and very limited oil reserves of its own, for decades Japan has relied largely on nuclear energy to fuel its industrial output and it has had to import fuel required to run its economy from foreign sources. Even with a largely nuclear-powered energy base, Japan has been forced to import fuel and the fuel it buys is subject to the “Asian Premium,” the nickname for a phenomenon where countries like Japan pay much more for oil and gas than other countries thanks to its tremendous demand. The EIA reports that “Japan is the world’s largest liquefied natural gas importer, second largest coal importer, and third largest net oil importer.”

The high cost of importing oil and gas has hit Japan hard in the three years following the Fukushima nuclear power plant disaster. In March of 2011, The Daiichi and Daini plants went into meltdown when a huge earthquake and tsunami hit Japan, and the cores of the plants melted as a result of damage to its cooling systems and failure of back-up cooling, which ceased working in the aftermath of the tsunami. Over 160,000 people were evacuated from the nuclear disaster zone, and many are still in temporary housing.

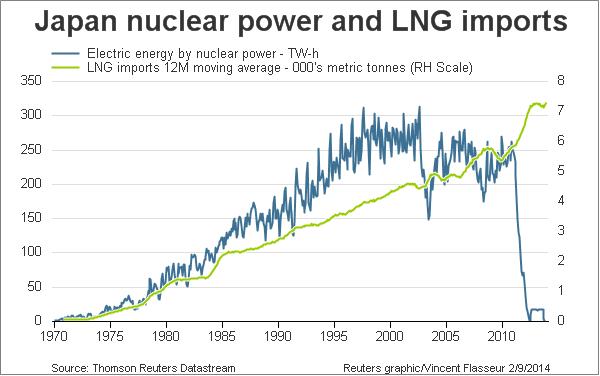

Nuclear energy is a cheap and reliable source of baseload electricity that allowed Japan to approach energy self-sufficiency for five decades. Nuclear power plants supplied almost a third of Japan’s electricity before Fukushima. But no longer.

After Fukushima, civilian trust in nuclear power is at an all-time low, and the nuclear power plants in Japan have slowly been taken offline, with the last one shutting down in 2013. Reuters said that there have been over 1,500 suicides in the prefecture since the Fukushima disaster, 54 of which have been ruled “disaster related.”

The stringent safety checks now imposed on nuclear power plants in Japan could limit restarts to about one third of its 48 nuclear reactors, according to Reuters. “Nine of Japan’s electric utilities have applied to restart 19 reactors.” Two reactors at the world’s biggest nuclear power plant, the Kashiwazaki Kariwa facility, were scheduled to start up July, 2014, but the project was postponed.

LNG In

With the bulk of its nuclear plants likely to remain offline for several years, Japan is looking for alternatives. One alternative the country has relied on since the Fukushima disaster is importing liquefied natural gas (LNG). Japan was responsible for 37% of global LNG shipments in 2012. The price of LNG in Japan fell from “more than $16 per MMBtu in February of 2012 to less than $12 per MMBtu in 2014.”

Looking to Russia for Fuel

Another solution Japan is considering is a natural gas pipeline from Russia to Japan, since Russia is actively seeking new markets for its gas.

Japan is proposing a $6 billion pipeline add-on from the approved $400 billion pipeline to China. However, China is unlikely to help their old rival, and Japan’s relationship with Russia is also shaky thanks to World War II territorial disputes and the increased sanctions against Russia that Japan made yesterday in response to the downing of Malaysia Airlines Flight 17.

But Daiske Harada, an economist with JOGMEC focusing on Russia, said Rosneft (ticker: ROSN) and Gazprom (ticker: GAZP) are more interested in pushing LNG to the Pacific market than waiting for a pipeline.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.