Sanchez Energy Corporation (ticker: SN) is a Houston, Texas, based, growth oriented, independent exploration and production company focused on the exploration, acquisition, and development of oil resources in the onshore U.S. Gulf Coast with a current focus on the liquids-rich Eagle Ford Shale, Austin Chalk, Buda Limestone, Pearsall Shale and Tuscaloosa Marine Shale.

Sanchez Energy’s aggressive drilling program from 2013 yielded quarterly record production of 1,731 MBOE (86% liquids) for Q4’13, according to an earnings release on March 5, 2014. The total is 60% greater than Q3’13 totals and an increase of 904% from Q4’12. Revenue also climbed to $130.1 million – increases of 38% and 679% compared to totals from Q3’13 and Q4’12, respectively. The company averaged roughly 18.8 MBOEPD during Q4’13.

Sanchez Energy recently presented at EnerCom’s The Oil & Services Conference™ 12 in San Francisco. Click here for a list of questions asked at their breakout session.

2013 Totals

Fiscal 2012 results pale in comparison to Sanchez’s 2013 campaign. SN recorded 3,872 MBOE in production and $314.4 in revenue, which are both company records and increases of 726% and 629% compared to 2012. Adjusted EBITDA of $226.7 million is 785% higher on a year-to-year comparison and adjusted net income of $33.2 million is an increase of 351%. Proved reserves climbed 177% to reach 58.7 MMBOE for a PV-10 value of $1.47 billion.

Sanchez currently has $154 million in cash on hand with an additional $325 million in undrawn funds from its credit facility. The company holds an option to increase its borrowing base to $400 million, but management said it does not believe the extra commitment is necessary.

Operations Review

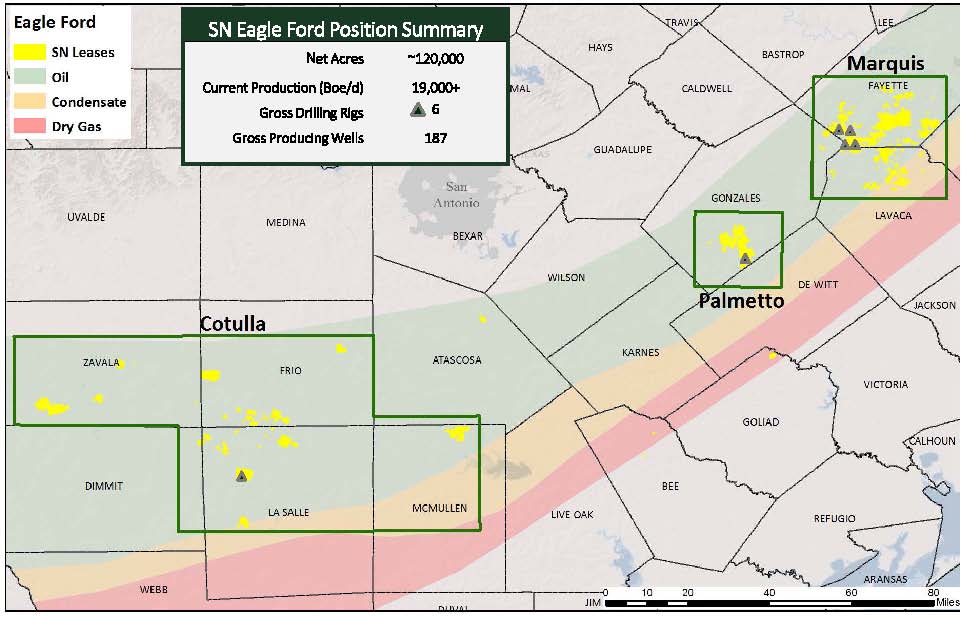

Sanchez enters Q1’14 with 200 gross producing wells in five project areas, which is 158 more wells than year-end 2012. Acquisitions added 74 gross wells while drilling operations contributed a total of 84 wells. The company is currently running seven gross rigs (six net) with an additional 15 gross wells awaiting completion. Drilling costs dropped 25% in Q4’13 compared to the previous quarter and completion costs for the same time period decreased by 35%.

Upward Production Trend Expected to Continue

Sanchez places production guidance for Q1’14 at 18 to 20 MBOEPD, which would be an increase of 6% if the high point is reached. Full year 2014 guidance is expected to reach 21 – 23 MBOEPD, which is roughly double 2013’s average of 10.6 MBOEPD. Roughly 50% of SN’s anticipated production is hedged, and management projects operating costs to remain consistent throughout the upcoming year.

SN has allotted $650 million to $700 million for its 2014 drilling plan, and roughly 90% of expenditures will be directed at development of its Eagle Ford assets. The company plans on continuing to run seven gross rigs and expects 70 net wells to be spud and completed. The Marquis assets are estimated to account for roughly half of both the expenditures and completions guidance.

Management said more wells were completed in 2013 due to increased drilling efficiency. In the Alexander Ranch area of the Cotulla Field, the operations team spud and drilled a well to total depth in less than eight days. Drilling and completion costs in the same region decreased to $6 million per well compared to $8.3 million per well when the team first commenced appraisals. Similar efficiency is taking place in the Prost area, where well costs have dropped to $8.5 million per well from $11 million to $14 million per well for the same period.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.