Transaction provides Goodnight Midstream access to $300 million incremental capital to accelerate growth

TPG Capital, the private equity platform of global alternative asset firm TPG, has signed a definitive agreement to acquire a majority stake in Goodnight Midstream, a leading midstream produced water infrastructure company, from Tailwater Capital for approximately $930 million.

TPG is acquiring the company from Tailwater Capital and private investors. Existing shareholders, including management, will retain a significant minority interest in the company.

“As the midstream water sector continues to develop and mature, we believe the company is well positioned to emerge as a leading provider of scale. We’re excited to support the company through its next chapter of growth.”

Under the terms of the transaction, TPG Capital and existing shareholders have agreed to commit additional equity capital to support the continued growth of the business. With additional growth equity and proceeds from committed debt financing, the company will have access to more than $300 million of capital to fund continued expansion.

The transaction is expected to close in the second quarter and is subject to customary closing conditions.

“Our business is focused on building long-term innovative and cost-effective produced water solutions,” said Patrick Walker, CEO of Goodnight Midstream. “Our piped systems save our customers money while reducing the environmental impact of oil and gas production. I’m proud of what our team has accomplished in eight years and look forward to leveraging TPG’s strong network and expertise in the midstream space as we continue to build the mission critical infrastructure required by our world-leading E&P customers.”

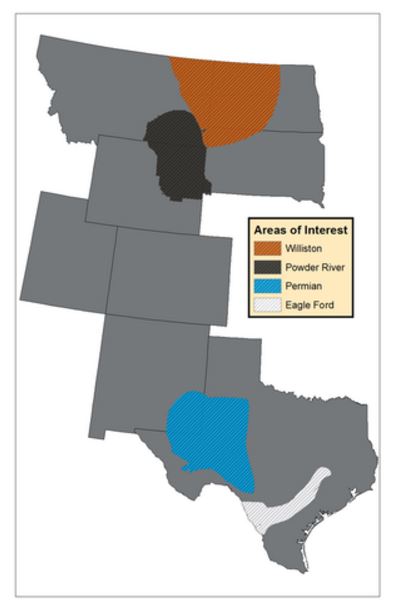

Goodnight Midstream has assembled a network of more than 420 miles of dedicated produced water gathering and transportation pipelines and more than 50 saltwater disposal wells. Goodnight gathers, transports, and disposes more than 350,000 barrels of produced water per day and has more than 800,000 dedicated gross acres and more than 1.4 million barrels per day of permitted water disposal capacity in the Permian, Bakken, and Eagle Ford, through long-term contracts with oil and gas producers.

TPG’s energy team has partnered with leading companies and strong management teams across the energy value chain. Investments have included Discovery Midstream, EnLink Midstream, Jonah Energy and Copano Energy, the company said in a statement.

BMO Capital Markets served as financial advisor and Kirkland & Ellis LLP served as legal counsel to TPG Capital. Jefferies LLC acted as lead financial advisor and Credit Suisse Securities (USA), LLC served as joint financial advisor to Goodnight Midstream. Vinson & Elkins LLP served as legal counsel to Goodnight Midstream.

[contextly_sidebar id=”cKrG4yjoULPPi0ANGgubNPpBcOlI2oz5″]