Producing Countries are Floundering, whileTwo Big Users Soar

Crude oil is one of the most important commodities in the world, with many economies around the world depending on producing and selling oil for the bulk if not all of their national revenues. The precipitous drop in prices over the last 18 months has changed the playing field for oil and gas producers, and many countries that leaned on $80 – $100+ crude oil to build up their economies are now are now facing dire straits in a world awash in cheap oil.

As crude oil prices sink below the $30 per barrel mark, and even below $20 for some grades of crude, the world is looking at a “lower for longer” scenario in which $100 oil no longer looks like a go-back-to possibility. Research from Stratfor Global Intelligence, a geopolitical intelligence firm, has identified key breaking points that could emerge in the world as the stress of low oil continues.

The U.S.A.: fewer hedges could spell trouble

Production has remained resilient in the U.S. despite the continued fall in oil prices, but 2016 could be a much more difficult year for U.S. E&Ps as financial hedges start to come off.

Last year, about a quarter of U.S. production was hedged in the $80-$90 range, Stratfor Energy Analyst Matthew Bey told Oil & Gas 360®. For 2016, around 10% of U.S. production is hedged, and in the $60-$70 range, leaving companies more exposed to lower prices than they were a year ago. “Companies are getting creative, though,” as they face lower prices, said Bey.

Canada: uneconomical at sub-$15 WCS

Canadian producers are also facing a difficult 2016, said the Stratfor analysis. The country’s crude oil benchmark WCS has been trading below $15 this week, making many projects, particularly heavy oil sands, uneconomical.

With limited capacity to reach refining in the Gulf of Mexico, Canadian crude is also unlikely to substitute any reduced production in the U.S., said Bey. If domestic production does fall in the U.S., producers in North and West Africa are the more likely candidates to pick up the slack.

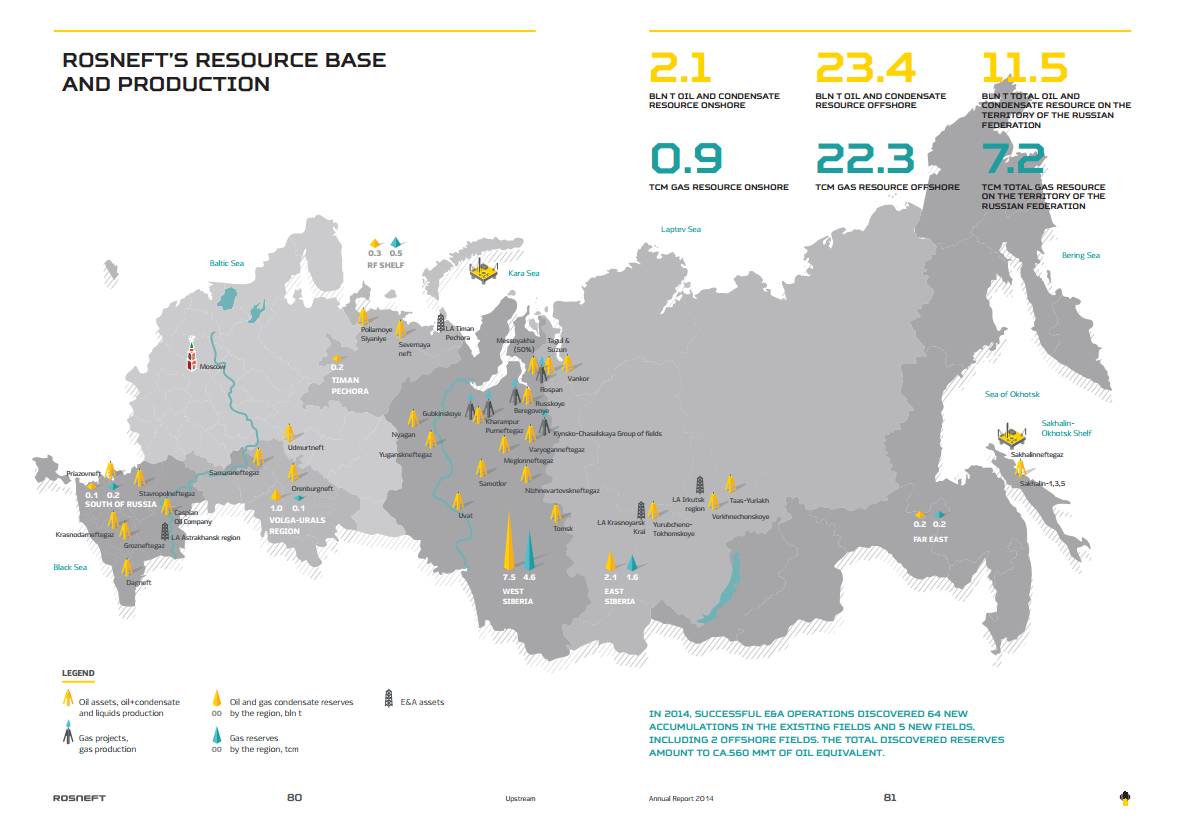

Russia: faces budget cuts to stretch remaining $59 billion in sovereign fund through 2016, but Putin not in danger

With roughly 25% of its GDP derived from energy exports, Russia is particularly vulnerable to cheap oil. Russia initially set its budget assuming $50 per barrel, but has since been forced to reconsider its spending.

Russian Finance Minister Anton Siluanov recently proposed a 10% cut to spending across the board, with the exception of pensions, in order to help balance the budget. The proposal would require Russia to reduce spending by about $6.5 billion in order to meet Siluanov’s goals.

We need to prepare for the worst scenario,” Prime Minister Dmitry Medvedev said in a speech at an economic conference in Moscow. “We need to live according to our means, including by reducing budget expenditures, decreasing spending on the state apparatus, [and] the privatization of part of state assets.”

Russia has been able to soften the blow to some extent through the use of its sovereign fund, but this too could quickly disappear. The $59.35 billion that remained in the fund at the end of November could be completely depleted in 2016 if measures to reduce spending are not introduced.

This scenario would spell trouble for leaders of most countries, but Stratfor believes President Vladimir Putin is likely to avoid any trouble in the near-term.

“Putin is still strong despite oil prices,” said Bey. “He has been able to spin tensions with the West to his advantage, characterizing them as attacks on Russia, and stoking nationalism.”

It is less clear how secure Putin might be in 2018 during Russia’s next presidential election cycle however. If cheap oil continues to put downward pressure on the Russian economy, Putin’s popularity may begin to slip with his countrymen.

Kazakhstan and Azerbaijan: former Soviet states at risk

Stratfor also identified Kazakhstan and Azerbaijan as being at risk in the current commodity price environment, with both countries concerned about growing social unrest in the face of weaker economies, but both “have proved adept at cracking down on dissent,” said the Stratfor report.

Saudi, Kuwait, UAE, Qatar, Bahrain, Oman: still retain enough funds to weather the storm

Despite Middle East producers like Saudi Arabia, Bahrain and Oman all needing oil prices above $89 per barrel in order to break even, most are not in significant danger at this point, according to the Stratfor report. “The Gulf Cooperation Council nations [Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman] are in a position to weather low prices, since they hold low levels of debt and high financial reserves built up from years of high oil price revenues.”

Despite this, many countries are already beginning to make adjustments. OPEC’s largest producer, Saudi Arabia, is cutting its overall budget by about 14% and reducing subsides in order to bridge its fiscal gap. The kingdom has even considered doing an initial public offering for certain portions of Saudi Aramco, the state-owned oil giant.

Oman, which is the largest non-OPEC producer in the Middle East, has expressed that it is willing to cut production by up to 10% if other countries join it in order to allow a balance that would lead to increases in oil prices.

Algeria, Iraq, Kurdish region, Iran: facing obstacles

Not every country is as fortunate as those in the Gulf Cooperation Council, however. Algeria ran a budget deficit of $10.8 billion in 2015, said Stratfor. A mild winter in Europe, and an expected transition of power will compound the problems the country already faces.

Both Iraq and the semi-autonomous Kurdish region are facing serious financial difficulties while trying to fight the Islamic State. Iraq is currently in the midst of trying to renegotiate its contracts with international oil companies, but the Kurdish region of northern Iraq has made it clear that it will export independent of the government in Baghdad.

Iran is also reentering the global oil market, hoping to add 500 MBOPD of production to an already oversupplied market. With crude worth 70% less than highs seen in 2014, President Rouhani may have difficulty maintaining support if Iran is unable to benefit from greater volumes of crude exports. Rouhani is up for reelection in February and may perform well following the end of international sanctions, but could face a tougher election cycle come 2017 as economic discrepancies become more obvious said Stratfor.

Venezuela and Ecuador: facing civil unrest

Perhaps the most vocal dissenter among OPEC’s members about the group’s policy of protecting market share has been Venezuela. President Maduro has called on OPEC members to set a policy with a price floor of $70 per barrel, but has been unsuccessful in changing the group’s policy.

Annual inflation is nearly at 300% based on leaked central bank estimates, reports Stratfor. Venezuela will likely need to reduce imports, and could even default on its foreign debt later this year, if cheap oil remains the norm.

“Further unrest is inevitable,” said the report. “The government will need to work to contain this from spreading too widely.”

Ecuador has also faced challenging times as OPEC continues to pump at record rates. Oil exports fell 30% in 2015 and are expected to stay low through 2016. Options exist for Ecuador, such as imposing trade barriers, but this would slow down economic growth, a dangerous move politically with elections approaching in February 2017.

Brazil: walking a tightrope

Brazil’s state-owned Petrobras has been placed under a microscope recently as corruption charges continue to be aimed at the company. This in combination with cheap oil has caused significant damage to Brazil’s economy.

“Unless the government decides to curb the major criminal investigation into the company and associated officials, the scandal will continue to disrupt supply chains and contractor financing,” said the Stratfor report.

Putting a pause on the corruption investigation would be “politically infeasible,” however, said Bey. It would be impossible to turn a blind eye to corruption inside Petrobras at this point, regardless of how it might disrupt the supply chain.

China and India: winning

While the outlook for major oil producing countries is certainly bleak, there are some nations who look to benefit from a world of cheap oil. “Consuming countries are definitely the winners here,” said Bey.

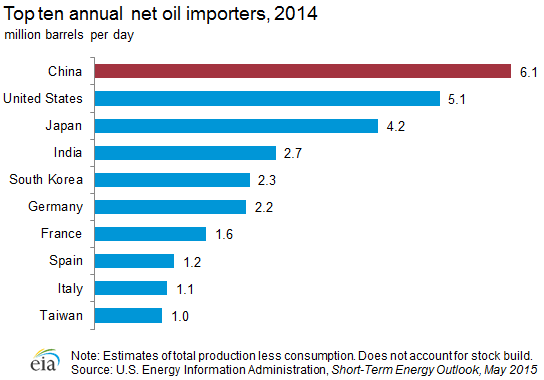

China and India, specifically are reaping the benefits of lower commodity prices. Despite concerns over China’s slowing economy, it is still the second largest consumer of oil behind the U.S., according to the Energy Information Administration.

India’s consumption has also been increasing, with oil representing one-third of imports by cost in 2013. India’s economic growth is also expected to outstrip China’s with the IMF reporting GDP growth of 7.3% in 2015, and an expected 7.5% in 2016.

As more assets become distressed in 2016, India’s state-owned ONGC may start looking to pick up more assets, said Bey. China may also start looking to pick up more production soon, but will likely wait to make any major moves until after the Chinese elections.