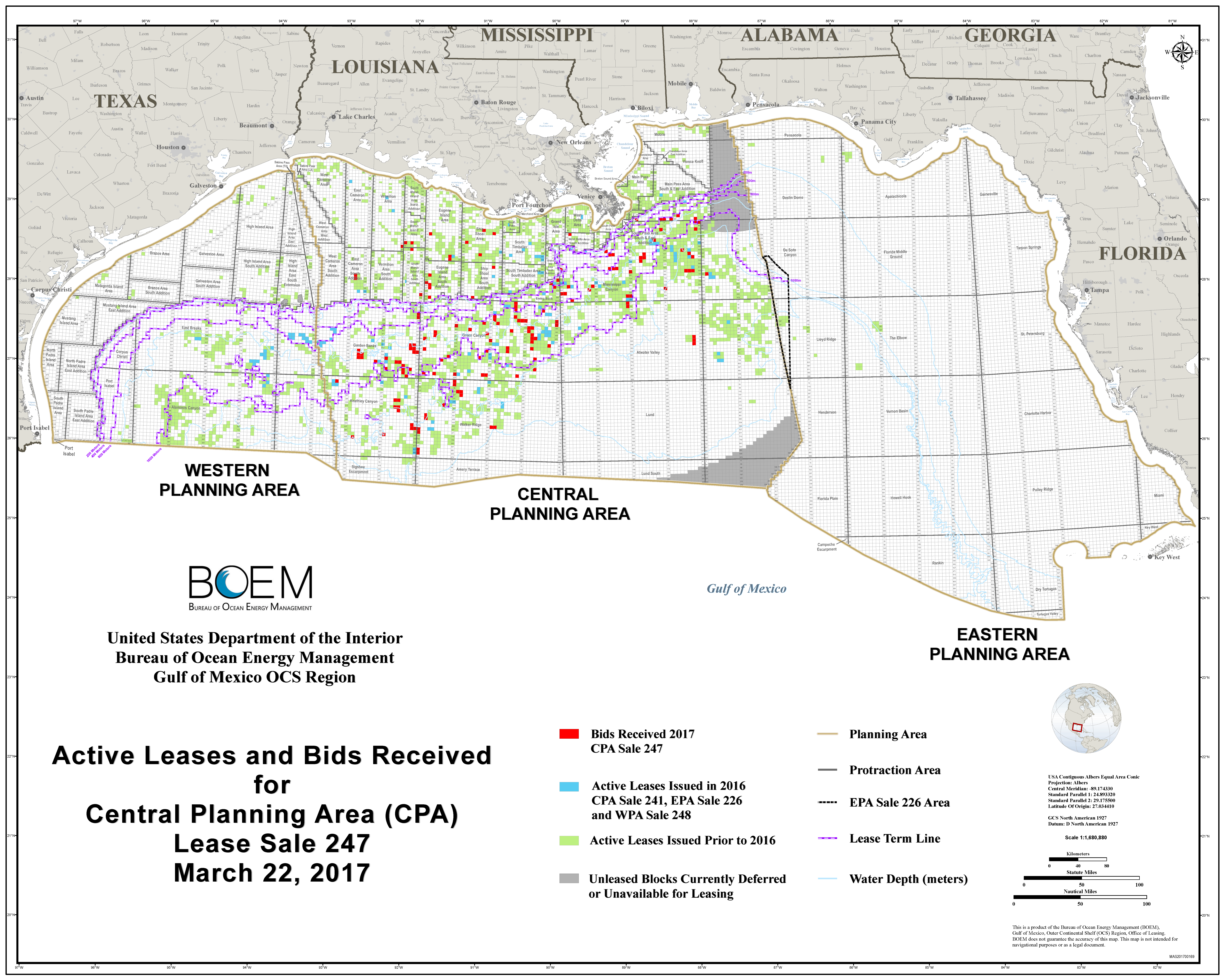

913,542 acres sold in Louisiana, Mississippi and Alabama

The Bureau of Ocean Energy Management announced the successful sale of available blocks in the GOM, with final bids totaling almost $275 million. A total of 163 tracts, or 913,542 acres in offshore Louisiana, Mississippi and Alabama were sold.

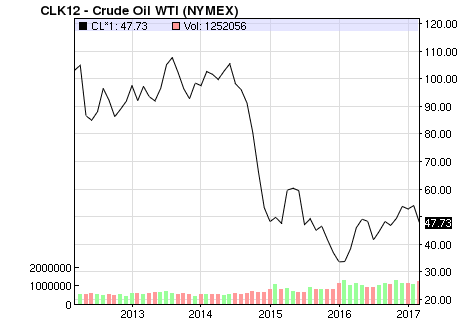

Companies were significantly more active in this lease sale than last year’s, when total high bids were $156 million. Activity is still far below historical levels, as previous bid activity totaled $539 million in 2015, $850 million in 2014 and $1.2 billion in 2013.

Shell purchased most, spent most

Shell Offshore was foremost in acquiring lease blocks with the most high bids, the most expensive single bid and the highest total amount bid. The most expensive single lease was the 5,760 acre Atwater Valley 64, which Shell purchased for just over $24 million. This equates to about $4,175/acre, far above the overall average of $300/acre. The Atwater Valley block represents almost half of Shell’s successful bids, which total $55.9 million.

Other notable successful companies include Chevron and Exxon Mobil, which bid $35.6 million and $21.9 million to secure 20 and 19 lease blocks, respectively.

Companies were less interested in deepwater leases than usual in this sale. The BOEM separates blocks into four depth categories, <1/8 mile, 1/8 to 1/4 mile, 1/4 to 1/2 mile, 1/2 to 1 mile, and deeper than one mile. In each of the past four sales, blocks deeper than one mile received both the highest total bids and most blocks sold. In this sale, however, blocks with depths ranging from 1/2 to 1 mile dominated, receiving more than half of the total bids.

Commenting on the sale, Secretary of the Interior Ryan Zinke said, “Today’s strong sale reflects continued industry optimism and interest in the Gulf’s Outer Continental Shelf, a keystone of the nation’s offshore oil and gas resources and a vital part of President Trump’s plan to make the United States energy independent. In cooperation with the Gulf offshore industry, we are committed to responsible energy development that spurs economic opportunities, generates jobs for American workers, and produces revenues for local, state, and federal partners.”