Oil prices above breakeven for three quarters of the year positive for drillers

On the whole, 2018 produced good news for U.S. oil and gas companies, at least through the first three quarters of the year. Prices were above breakeven level for the first nine months of 2018, allowing producers to kick drilling plans and capital usage into high gear, boosting production to record levels during the year.

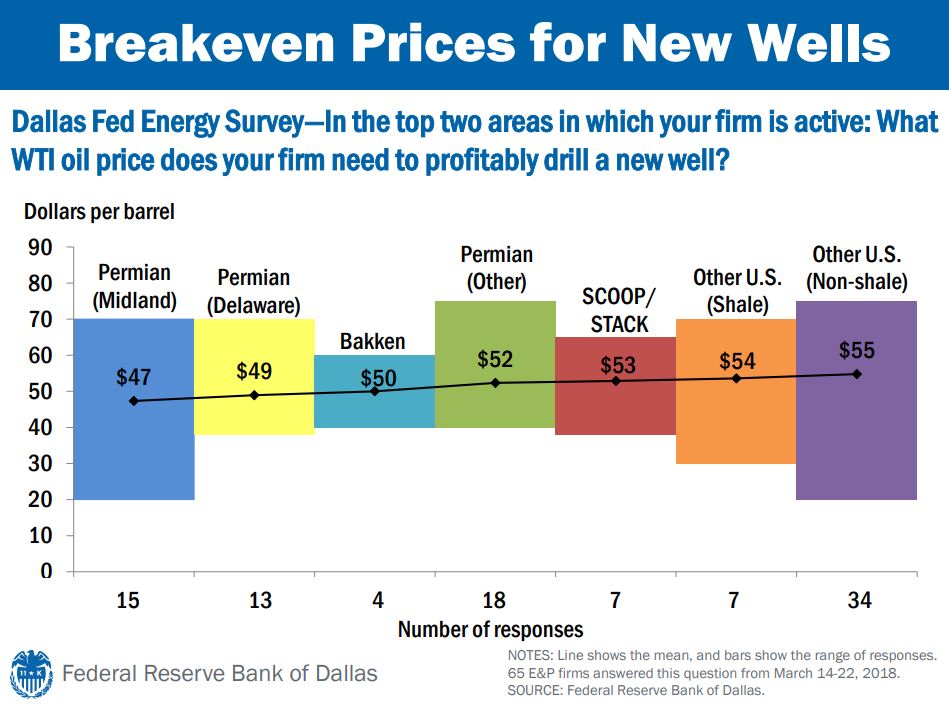

A global oil glut that had wreaked havoc on the industry in 2015 and 2016 was declared ‘neutralized’ entering the year, and oil prices above breakeven were in force during most of the year, with WTI sitting above $60 for three quarters, above $65 for two of those quarters. The benchmark U.S. crude oil price exceeded $70 per barrel four times during the year and punched through $75 at the beginning of October.

Q1-Q3 2018: Higher oil prices brought liquidity, growth

The return of higher oil prices that lasted through the first three quarters of 2018 led to the homecoming of liquidity, profitability, accelerated drilling and development activity, share buybacks, and some new and increased dividends.

The shale industry returned to an almost frenetic pace of development during 2018, especially in the Permian Basin—but in a much more efficient way, technologically, operationally and fiscally.

[contextly_sidebar id=”zuhuGkVn7yf0VpDfcGES4bjKRkDvDNl8″]

Q4 2018: quarter-long oil price slide led to pullback announcements for 2019

The fourth quarter saw oil prices begin a rapid slide, all the way down to the mid-$40s, price levels not seen since the first half of 2017. The quarter-long bear market for oil has resulted in some companies engaging in cost-cutting and publishing an initial wave of downwardly revised CapEx budgets for 2019. But most of the companies publishing lower investment guidance for next year are not cutting their production guidance by very much. In fact some of the majors are just ramping up in the Permian.

The EIA predicted this month that U.S. crude oil production will average 10.9 million barrels per day in 2018, up from 9.4 MMBOPD in 2017, and that U.S. production will average 12.1 MMBOPD in 2019.

IEA chief sees U.S. oil production “nearly equal” to Russia and Saudi – combined – by 2025

Meantime, Fatih Birol, International Energy Agency (IEA) chief, took the predicting game farther last Friday, telling a Turkish news agency that he believes total oil production in the United States will be nearly equal to that of the combined total production of Russia and Saudi Arabia by 2025, according to a Reuters report.

The U.S., Saudi Arabia and Russia are the world’s biggest oil producers, together pumping around one-third of the world’s 100.7 million barrels per day in October, which was about 2.6 million barrels above the same period in 2017.

But the U.S. oil industry being on the free market plan, when oil prices fall below breakevens for an extended period as they did between 2014-2016, drilling slows and production declines eventually follow, and Birol’s prediction would be invalidated.