Russian Companies Top the List

Forbes has released its 2016 ranking of the world’s largest public oil and gas companies.

With 2015 in the books, after a year of turmoil in a capital-intensive industry that was slammed by diving oil and natural gas prices, here are the largest producing public oil and gas companies that sit atop the newest Forbes list, ranked in order of production.

Quick Facts

- USA is home to 28% of the largest companies, 21% of the group’s total production and 30% of the group’s total enterprise value.

- Russia is home to 16% of the largest companies, 32% of the group’s production, and 7% of the total enterprise value.

- China is home to 12% of the largest companies, 13% of production, and 30% of the group’s enterprise value.

- Canada is home to 8% of the largest companies, 3% of production, and 3% of the enterprise value.

- EU countries are home to 20% of the largest companies, 20% of production, and 21% of the enterprise value.

Methodology

Forbes’ author Robert Rapier said he screened the proprietary database of S&P Global Market Intelligence, “which includes 2,367 publicly traded companies across the energy sector, and from stock exchanges all over the world. If there were questions or uncertainties about the data (e.g., reported numbers were outdated) I used corporate earnings reports and presentations.”

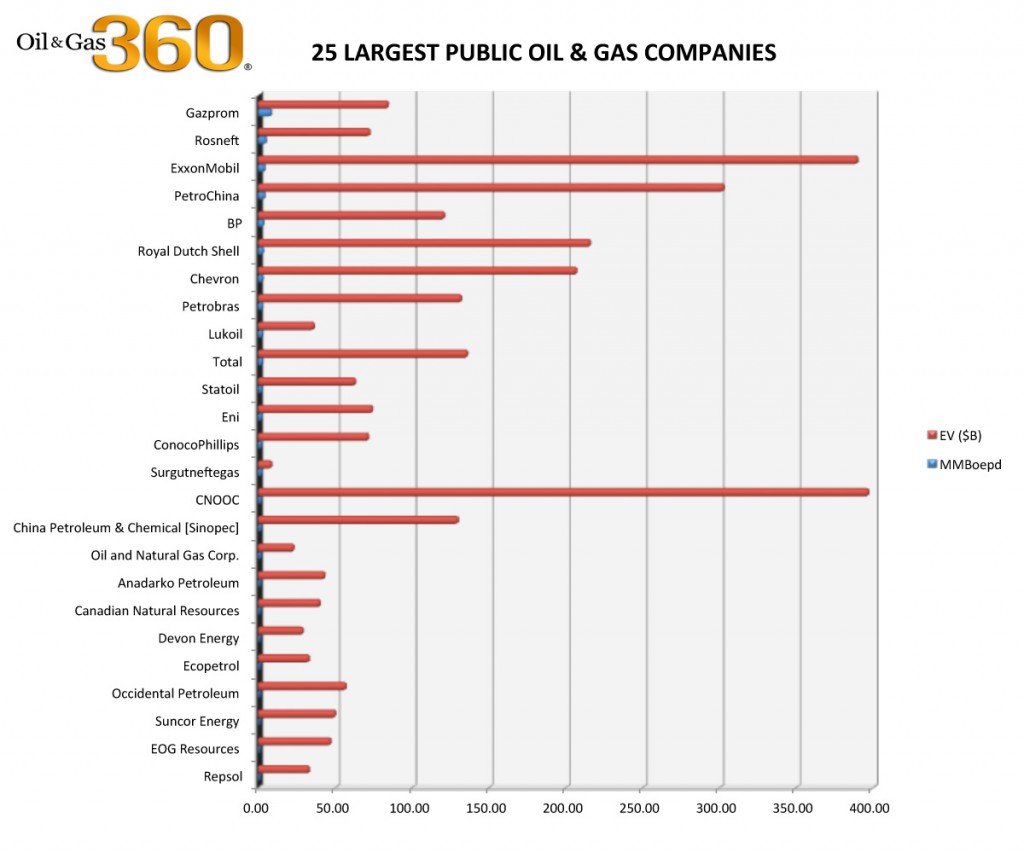

Companies headquartered in Russia, the USA, China and the UK took the top five slots. (All data compiled by Forbes; production shown in barrels of oil equivalent for 2015: MMBoepd = million barrels of oil equivalent per day; EV = Enterprise Value).

Forbes’ List of the 25 Biggest Public Oil & Gas Companies

- Gazprom (ticker: GAZP, com) – Russia – 8.38 MMBoepd – EV $84.3 billion

- Rosneft (ticker: ROSN, com) – Russia – 5.07 MMBoepd – EV $72.5 billion

- ExxonMobil (ticker: XOM, com) – USA – 4.10 MMBoepd – EV $390 billion

- PetroChina (ticker: PTR, com) – China – 4.07 MMBoepd – EV $303 billion

- BP (ticker: BP; com) – UK – 3.24 MMBoepd – EV $121 billion

- Royal Dutch Shell (ticker: RDS.A – com) – Netherlands – 2.95 MMBoepd – EV $216 billion

- Chevron (ticker: CVX; com) – USA – 2.62 MMBoepd – EV $207 billion

- Petrobras (ticker: PBR; com) – Brazil – 2.55 MMBoepd – EV $132 billion

- Lukoil (ticker: LKOH; com) – Russia – 2.40 MMBoepd – EV $36.2 billion

- Total (ticker: TOT; com) – France – 2.35 MMBoepd – EV $136 billion

- Statoil (ticker: STO; com) – Norway – 1.81 MMBoepd – EV $63 billion

- Eni (ticker: E; com) – Italy – 1.69 MMBoepd – EV $74 billion

- ConocoPhillips (ticker: COP; com) – USA – 1.59 MMBoepd – EV $71.5 billion

- Surgutneftegas (ticker: SGTZY; ru) – Russia – 1.49 MMBoepd – EV $8.5 billion

- CNOOC (ticker: CEO; com) – China – 1.36 MMBoepd – EV $397 billion

- China Petroleum & Chemical [Sinopec] (ticker: SNP; com) – China – 1.32 MMBoepd – EV $130 billion

- Oil and Natural Gas Corp. (ticker: ONGC; com) – India – 1.07 MMBoepd – EV $23 billion

- Anadarko Petroleum (ticker: APC; com) – USA – 840,000 Boepd – EV $43 billion

- Canadian Natural Resources (ticker: CNQ; com) – Canada – 790,000 Boepd – EV $40 billion

- Devon Energy (ticker: DVN; com) – USA – 680,000 Boepd – EV $29 billion

- Ecopetrol (ticker: EC; com) – Colombia – 670,000 Boepd – EV $33 billion

- Occidental Petroleum (ticker: OXY; com) – USA – 650,000 Boepd – EV $57 billion

- Suncor Energy (ticker: SU; com) – Canada – 580,000 Boepd – EV $50 billion

- EOG Resources (ticker: EOG; com) – USA – 570,000 Boepd – EV $47 billion

- Repsol (ticker: REP; com) – Spain – 560,000 Boepd – EV $33 billion

NOTE: read the updated list for 2018 here.