American Majors Avoid Shallow Water Round

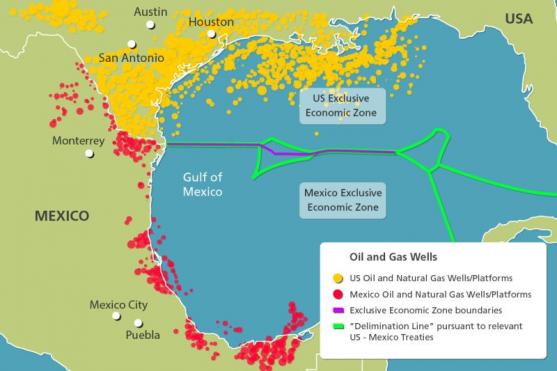

Mexico offered its first auction for oil and gas rights in 77 years today.

It presented a total of 14 blocks in the shallow Gulf of Mexico. A handful of bids were received but only two blocks were sold, a result of some bids not measuring up to requirements from Mexico’s Energy Ministry.

Only nine of the 25 companies who signed up for the auction submitted bids. Supermajors like Chevron (ticker: XOM), ExxonMobil (ticker: XOM) and Total (ticker: TOT) were not part of the nine, but overseas companies like ENI (ticker: E), Lukoil (ticker: LUKOY), Petronas and Statoil (ticker: STO) jumped in on the action. Petroleos Mexicanos (Pemex), the country’s previous nationalized oil producer, qualified to bid but did not participate.

Mexico’s First Independent Wins 2 Blocks

Sierra Oil & Gas, Mexico’s first independent hydrocarbon company, won two separate blocks as part of a consortium with Premier Oil & Gas of the United Kingdom and Talos Energy of Houston. The blocks were won with no incremental investment but the lease requires that Mexico’s government receives 56% and 69% of proceeds, respectively.

According to Mexico’s National Hydrocarbons Commission, nine of the 14 oil blocks have probabilities of commercial success ranging from 20% to 36%, and their prospective resources range from 164 to 384 MMBOE. Two other blocks have higher success probabilities of 42% and 54%, while the lowest has only 6%.

A Tough Market

The results are somewhat similar to the last auction held by the United States’ Bureau of Ocean Energy Management in March. Commodity prices weighed heavily on bids and resulted in less than half of the revenue from the previous Gulf auction. Freeport-McMoRan, a regular bidder, did not even sign up for participation.

Next for Mexico

A deepwater auction will take place in the future, though an official date has not been announced. Interests in deepwater opportunities like Petrobras, for example, have received billions of dollars’ worth of bids.

Midstream Seeing Action

Onshore activity, however, is slowly starting to pick up in the midstream market. Mike Howard, chief executive officer of Howard Energy Partners, spoke at length with Oil & Gas 360® about Mexico’s opportunities in a recent feature interview. His company is planning to build a 200-mile, 30-inch natural gas pipeline connecting its existing Webb County Hub in Webb County, Texas, to Escobedo, Nuevo Leon, Mexico, and the Mexican National Pipeline System in Monterrey. Sempra Energy (ticker: SRE) announced a $108 million project today that would transport more than 1.1 Bcf/d of natural gas to Chihuahua.