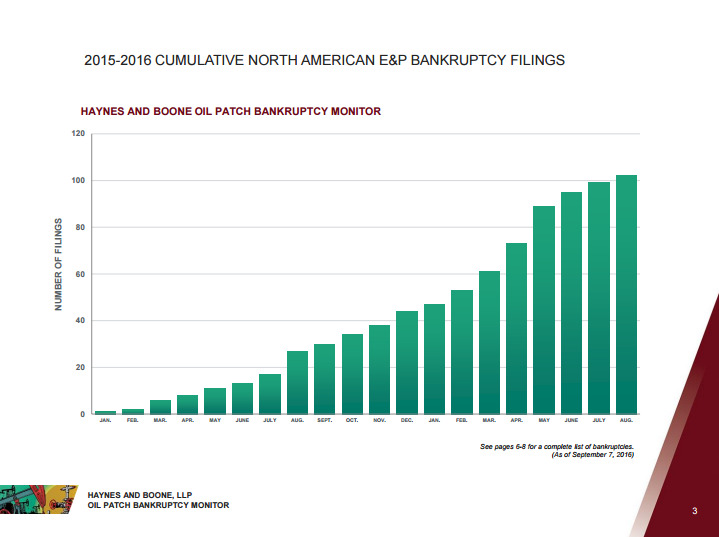

Oil & Gas Bankruptcy Continues to Climb to $50.4 Billion in August

Three more companies joined the ranks of those that have filed for Chapter 11 bankruptcy protection since the fall in oil prices. The three companies had combined debt of approximately $367 million, bringing the total number of oil and gas producers to file for bankruptcy in 2016 to 58, and a total combined debt of $50.4 billion, according to Haynes and Boone’s Oil Patch Bankruptcy Monitor.

The total number of North American oil and gas producers to file for bankruptcy since the beginning of 2015 is now at 102. The total secured and unsecured debt for those filings is approximately $67.8 billion.

Companies emerging from bankruptcy quickly

A number of companies that filed in recent months have already emerged from Chapter 11 with new capital structures. Many companies have been reaching agreements with their creditors before filing for bankruptcy, creating prepackaged bankruptcies that allow the companies to move through the process quickly.

Most recently, companies like Penn Virginia Corporation and Halcon Resources (ticker: HK), have come out of bankruptcy in a matter of months. Halcon’s case took 57 days, while Penn Virginia’s took roughly three months to work its way through the courts. Through Chapter 11, Halcon and Penn Virginia were able to reduce their debt by $1.8 billion and $1.1 billion, respectively.

“There are a lot more folks today taking companies into bankruptcy, and they’re looking to pre-negotiate the whole deal,” said Blackhill Partners Managing Director Jeff Jones. “So they cut a deal with the bond holders and they cut a deal with the lien holders, and they get the agreement of 80% of the parties on what this plan structure is going to be, and therefore, it goes much more quickly. Those are usually well negotiated and researched, and they’re usually set up a good amount of time in advance.”

Even though companies are coming out of bankruptcy more quickly than in the past, most are making very conservative estimates about the future. Companies do not want to get their restructuring wrong in Chapter 11 and come back for a second round in the courts.

“It’s an embarrassment to all the advisors, especially the financial advisors who should know better than to let their client come out with an unwieldy capital structure,” said Jones.

Haynes and Boone Partner Patrick Hughes told Oil & Gas 360® that analysts with whom he had spoken thought the industry was only one-third of the way through the bankruptcy cycle, meaning there could be even more to come in the near future.