The 1980s: a rough decade for cars, rock music and oil

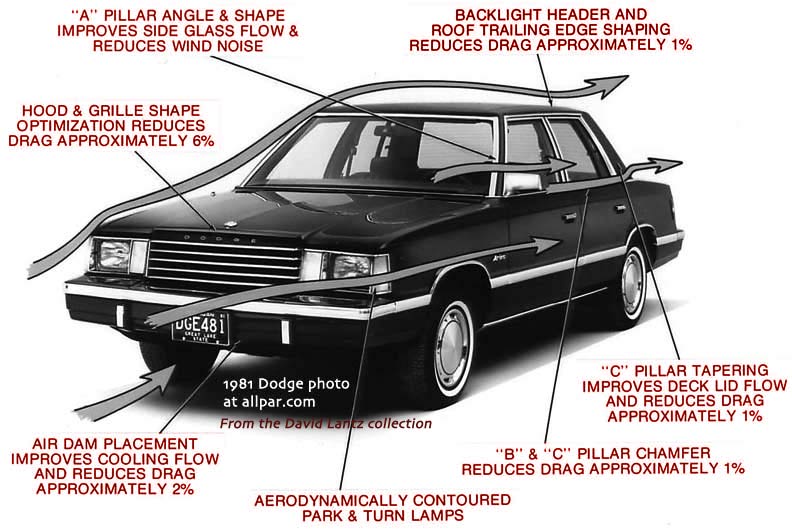

The 1980s were a mixed up decade. Killer British-driven rock music and groundbreaking R&B artists were giving ground to wimpy, fake artists like Milli Vanilli. The era of glasspack, dual carb, Hurst-shifted Detroit muscle cars had thrown in the towel to embarrassing vehicles like Chrysler’s K-car. The U.S. had only one car in the list of the world’s fastest cars in 1986: the ’86 Ford Mustang, which could go zero-to-60 in 7 seconds and had an MSRP of $14,750. The winner that year was an ’86 Ferrari that could go zero-to-60 in 4.5 seconds.

It has been 30 years since the 1986 crude oil collapse, and the industry faces a similar situation today as it did then. Global markets are oversupplied with crude oil, and OPEC has eschewed its role as swing producer in order to defend its market share.

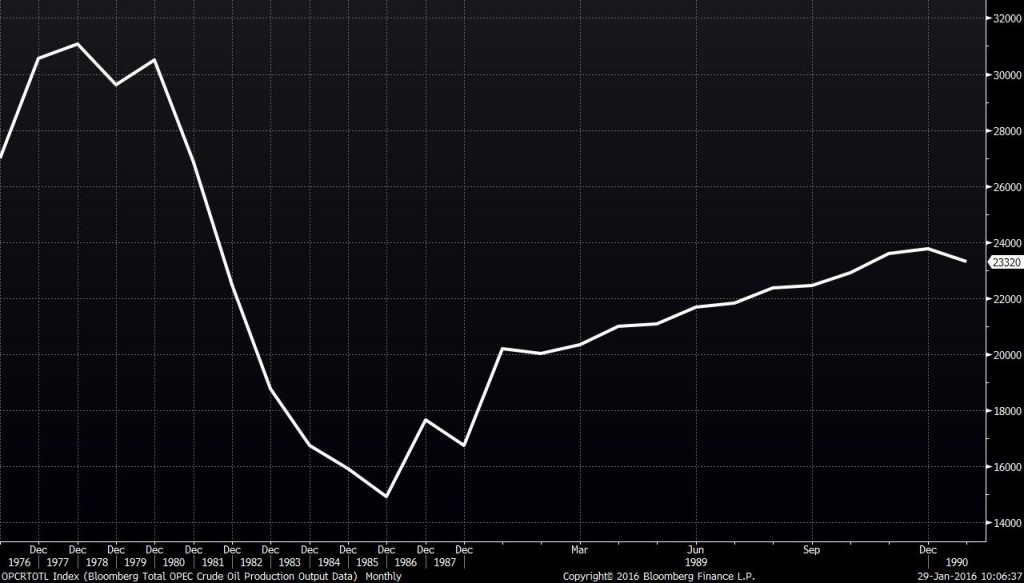

In the early 1980s, oil prices began to decline, prompting OPEC to cut production in order to bolster the value of its lifeblood. Saudi Arabia produced over 10 MMBOPD from October 1980 through August of 1981, but cut back to just 2.3 MMBOPD by August of 1985 in order to protect prices, according to the Energy Information Administration. It was hoped that prices would go higher as production slowed, but other members of OPEC continued to produce, leaving Saudi Arabia to shoulder the burden of lower production and prices.

In late 1985, Saudi Arabia abandoned its strategy of propping up prices, and instead began increasing production in order to increase market share. By July 1986, the average per-barrel free on board (FOB) price for OPEC crude oil had dropped to $9.85 from $23.29 in December 1985, a 58% decline in a matter of months.

The U.S. oil industry hits a wall

The dramatic drop in oil prices made production that had been brought online during the 1978-1980 oil crisis rapidly uneconomical. In late 1985, nearly 2,300 rigs were drilling wells in the U.S.; a year later, there were less than 1,000.

Declining domestic production meant that more oil needed to be imported, and crude oil was brought in from outside the U.S. at increasing rates. U.S. crude oil imports reached 9.1 MMBOPD in 2000, up 184% from 3.2 MMBOPD in 1985.

Unemployment in the oil and gas industry shot up, with an article from the L.A. Times published in June 1986, saying the oil and gas industry laid off 100,000 workers in the first five months of the year.

Black Sunday

The losses were compounded further in places like Colorado, where in 1982, the oil and gas industry in the state’s Western Slope collapsed following Exxon’s departure. The day the news became public, May 2, 1982, became known as Black Sunday in Colorado. 2,200 oil shale workers were laid off from Exxon’s Colony Project, and the local economy took a dive as residents scrambled to get out of town.

“The best business to be in at the time would have been the moving business,” said Herb Bacon, who worked for U.S. Bank of Grand Junction in 1982. From 1983-1985, some 24,000 people and $85 million in annual payroll left the Western Slope while unemployment climbed from near 0% to 9.5%, all before the larger crude oil market crash.

30 years later, the story sounds similar, but it’s not the same

Many comparisons can, and have, been drawn between the current state of the crude oil market and the crash of ’86 that happened three decades ago this year.

The drop in prices came after a Saudi-led decision from OPEC to maintain production and protect market share over prices on Thanksgiving Day, 2014, although there were no production cuts prior to the decision to raise prices. OPEC said producing low-cost resources, like its own, should be the priority while higher-cost plays—i.e., tight oil from shale developers in the U.S.—remained in the ground.

Oil prices plunged again, even more dramatically. International crude oil benchmark Brent fell 76% from June 19, 2014, when it traded at $115.06, to January 20, 2016, when it closed at $27.88. U.S. crude benchmark WTI saw a similar fall, shedding 75% of its value over the same time period, closing January 20, 2016, at $26.55, down from $107.26 on June 20, 2014.

Rig counts and employment in the U.S. oil and gas sector again took a dive following the depreciation of crude’s value. E&P companies cut their capital budgets by 30% year-over-year from 2014 to 2015, while the OilService sector decreased budgets by 28%, on average.

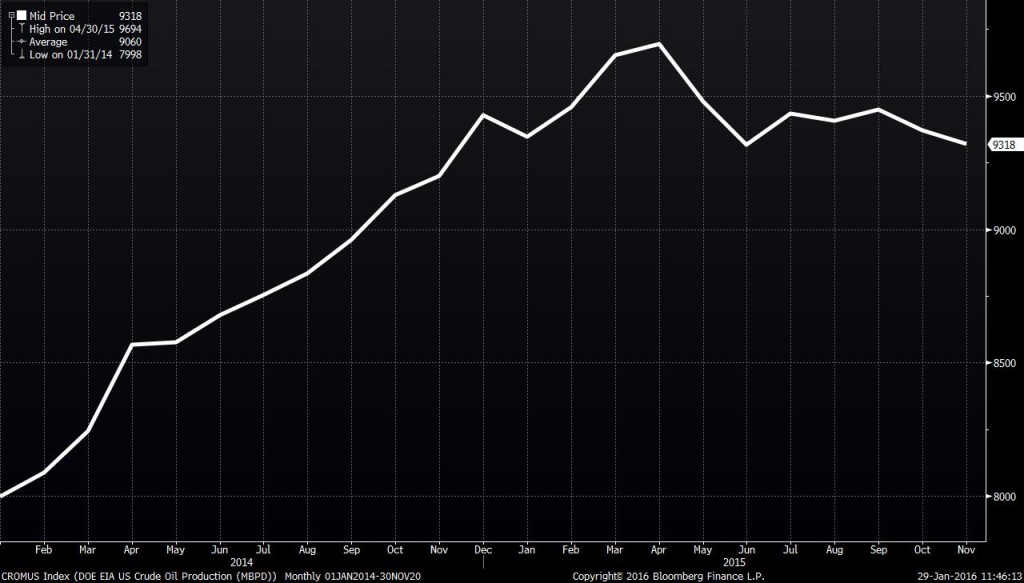

But not everything has remained the same 30 years after the last crude oil crash. U.S. shale oil production was much more resilient than many had anticipated, with hedges protecting a portion of production in 2015. Operators also began keenly focusing on efficiencies, and high-grading, or drilling their best assets, which pushed production higher after OPEC’s Thanksgiving Day decision.

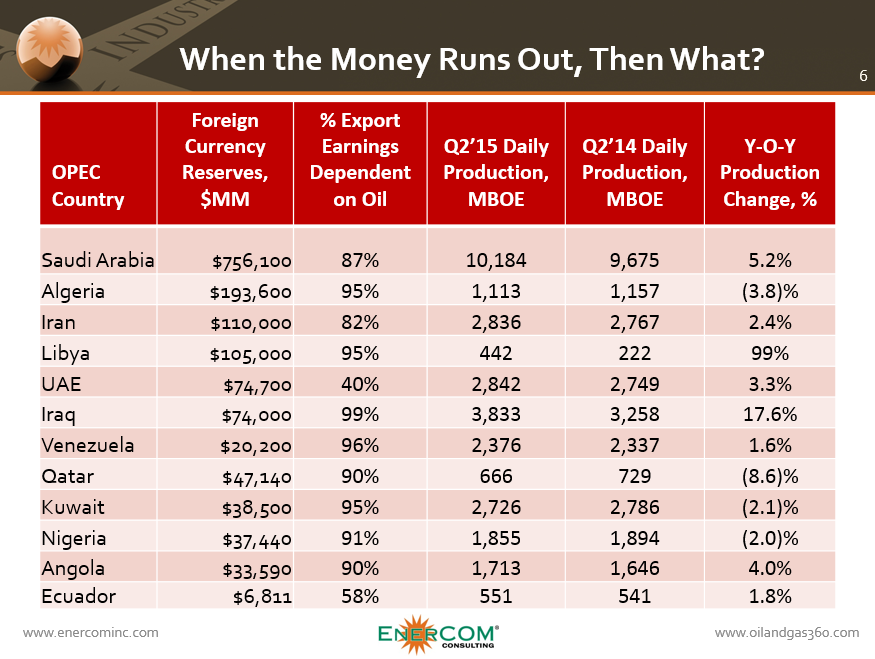

The high cost of OPEC’s low-cost production

While the decision to continue producing certainly created stress inside the oil and gas industry, not all of it was on U.S. shale producers. Many of OPEC’s members have been forced to draw down their sovereign wealth funds in order to bridge the gap in their budgets, which are highly dependent on oil export revenues to pay the high cost of social programs for their millions of subjects.

For wealthier Persian Gulf countries like Saudi Arabia, this has worked so far, but other members have not been as fortunate. Libya, in particular, is expected to need large loans through the rest of the decade, with its borrowing as a percent of GDP reaching 68.15% this year, and an expectation that it will need to borrow 43.35% of its GDP next year as the country deals with both low oil prices and a civil war, according to the IMF. Venezuela is also expected to borrow substantial amounts of money, with the international lender of last resort projecting the country will borrow 20%-22% of its GDP through the end of the decade.

The longer OPEC continues this strategy, the more damaging it will be to its finances as well, according to the International Energy Agency. In its annual forecast, the IEA predicted that if prices remain low, OPEC exports would be 6 MMBOPD higher, but total revenue would be $0.4 trillion less compared to a base-case model.

“All of the OPEC countries lose more from lower prices than they gain from higher volumes over the longer term,” the IEA wrote in its report. “This is one of the main reasons why a Low Oil Price Scenario looks less likely the further it is extended into the future: it relies on the active consent of the countries that are worst affected by the outcome. The assumed OPEC strategy of pursuing market share is effective, but ultimately also costly to the producers themselves.”

Prices returning to historic normal while U.S. increases efficiencies

Oil prices remain below $35 per barrel, but are continuing their upward trend from the middle of last week. Both WTI and Brent have added more than $7 per barrel to their value since hitting their respective lows on January 20.

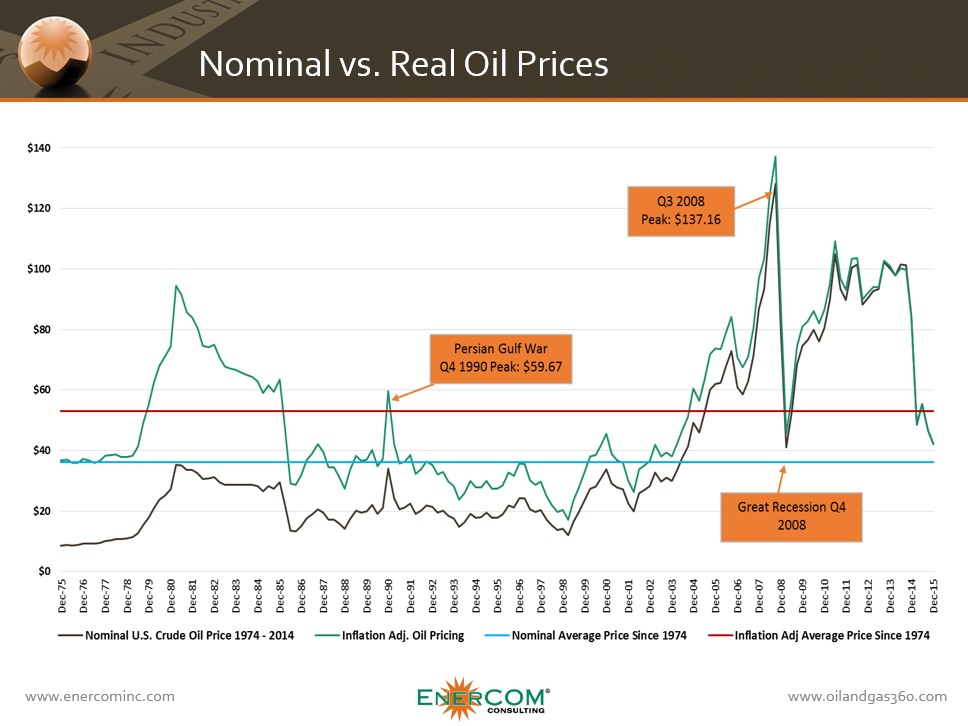

Most analysts do not expect oil to reach the triple digit levels seen prior to November 2014 in the near future, if ever, but they actually may be approaching normal historic levels.

Looking at oil prices back to the first quarter of 1974 forward to Q2’2015, EnerCom Analytics found that the average nominal price for U.S. crude oil over the 41-year span was $35.97. Adjusting for inflation, that price comes to $53.12, well below the $100+ oil prices that were seen between 2010 and 2014, at the heart of the shale revolution.

While it certainly won’t allow for all of the production that was shut in after November 2014 to come back online, as prices approach historical norms, more production from U.S. shale plays will come out of the ground.

Compared to 30 years ago, the investment cycle on new production in the U.S. is much shorter. It took decades and billions of dollars to produce from the Gulf of Mexico and the North Slope of Alaska. Today, the development of a shale well takes weeks, and many shale developers have brought efficiencies into play that pushed their per-well costs well below 2013’s levels, for instance.

Black Sunday in the early ‘80s and the crash of 1986 were pivotal moments for the oil and gas industry, and no doubt Thanksgiving 2014 will be remembered in exactly the same way, but the stories are not identical. While similarities exist in lower prices, rig counts and employment, today U.S. production remains stronger than most expected. The industry took a hit, but it also became more efficient, and companies have jockeyed and prepared to either survive or take advantage of the current crude oil environment.

When interviewed at EnerCom’s The Oil & Gas Conference in August, 2015, Tom Jorden, Chairman and CEO of Cimarex Energy summed the situation up like this: “I think the challenge to Cimarex and to companies in our space is to figure out how you get your business sustainable. Don’t be a shipwreck victim, the rescue ship is not coming.”